11. How are benefits related to companies' share awards or share options taxed?

You have to pay Salaries Tax on benefits associated with stock-based awards arising from your office or employment.

If you are granted a right to acquire shares within a period of time in the future (i.e. a share option), you will be assessed for tax under section 9(1)(d) of the Inland Revenue Ordinance when you exercise, assign, or release that option, but not at the time the option is granted to you.

An award of shares to you other than in the form of options (that is, you are given actual shares) may also give rise to a benefit assessable as a perquisite under section 9(1)(a) of the Inland Revenue Ordinance. In this case you will be assessed for tax in the year you are awarded the shares.

Any profit or loss from your subsequent sale of the shares is typically not taxed or deductible.

Benefits related to share awards

If shares are awarded to you free of charge, the market price of the shares will be included in your assessable income. If the market price is $5, then that $5 would be added to your assessable income.

If you are allowed to buy shares at 80% of the market price and you pay $4 for a share that is worth $5, then $1 would be added to your assessable income.

If you are allowed to buy shares at $5 when the market price is $5, there is no benefit and therefore there is no tax implication.

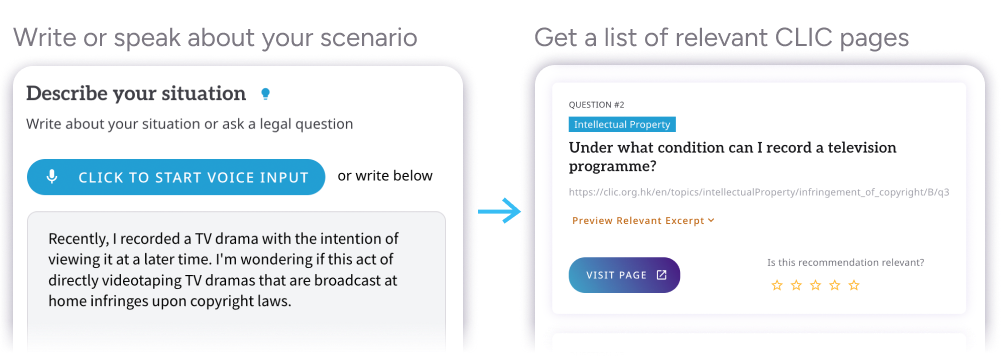

Such grant of stock or share awards constitute taxable perquisites. The terms regulating the awards and the circumstances under which the awards are awarded will often determine when the benefit is derived and when it is valued for tax purposes. You should report benefits from share awards in Part 4.1 of your Tax Return – Individuals.

Benefits related to share options

The difference between the price paid and the market price at the time of exercise is, broadly speaking, the tax advantage of the share option. For example, if you exercise a right to buy shares at $3 when the market price is $5, you pay tax on $2.

The amount of gain made from the assignment or release of a share option is usually the actual amount of money received by you from such assignment or release, less costs for acquiring the option, if any. You should report benefits from share awards in Part 4.1 of your Tax Return – Individuals.

Example

Company X is a listed company in Hong Kong. On 25 March 2021, it granted Mr. C, its marketing manager, the following share option: A right to acquire 500 shares of Company X at a price of $100 per share within 3 years from 1 May 2021.

Mr. C exercised the option on 2 June 2022 and paid $50,000 to acquire 500 shares of Company X. On the exercise day, the market price of Company X's share was $140.

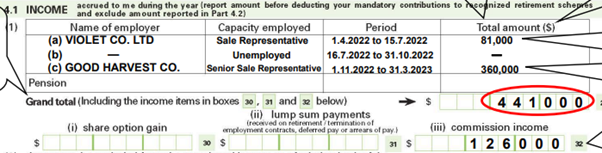

Mr. C has obtained a "share option gain" chargeable to Salaries Tax by the exercise of his share option. His assessable income for the year of assessment 2022/23 is computed as follows:

| | $ |

| Share option gain $(140 - 100) x 500 | 20,000 |

| Add: Other assessable income, say | 600,000 |

| Total assessable income | 620,000 |

Mr. C's employer should report this "share option gain" in the Employer's Return.

For more information on the above issue, please click here.

Print

Print Email

Email